Why choosing the right day trading strategies for the market conditions is crucial to your trading success.

One of the most common day trading mistakes is applying the wrong day trading strategies for the current market conditions.

That’s pretty much guaranteed to give you a series of losing trades, high stress levels, and negative P&L.

The goal of this article is to provide a basic understanding of how markets really work and how to determine which day trading strategies may provide the best trading opportunities & results on any given day.

So let’s jump right in and get started…

According to dual auction market theory, markets can do only one of two things;

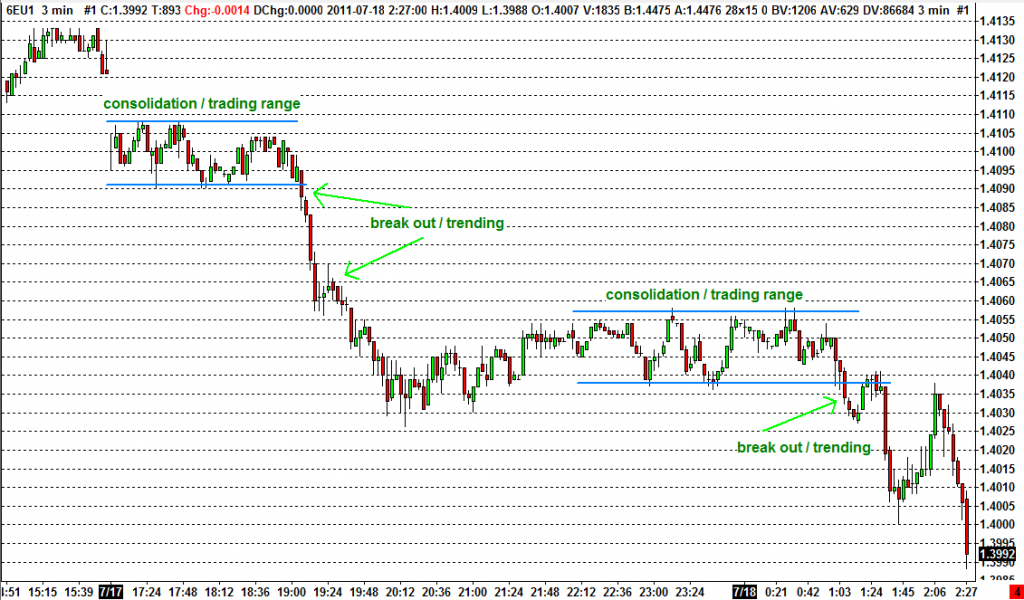

They can either move sideways, ‘rotating’ up and down between two price levels – otherwise known as a ‘consolidation’ or a ‘trading range’.

Alternatively, the markets can move directionally – otherwise known as ‘trending’. This occurs when the market breaks out from its trading range and moves directionally until the market begins to consolidate sideways again.

Understanding this dynamic is crucial for consistent day trading success. Why? Simply because being able to identify the current market conditions means we can apply the most appropriate day trading strategies for those conditions!

Each of these two basic market conditions (consolidating vs trending) require very different day trading strategies. There is no one-size-fits-all solution. We must be able to adapt our strategy accordingly to fit the market conditions.

Why does this matter?…

As an example, ‘directional’ day trading strategies are typically most effective when the market is trending strongly. However, trying to employ a directional strategy while the market is consolidating in a tight trading range will more often than not get you chopped around and stopped out of trades.

The intraday emini Euro chart below illustrates these principles of consolidation vs trend discussed in this article so far.

Hopefully you now understand why we need different strategies for different market conditions. So let’s take a look at two basic day trading strategies.

Almost every other technical day trading strategy in existence is a variation on the basic themes outlined below. It’s important to understand them.

Reversion to Mean

In a trading range the market typically ‘rotates’ slowly up and down without much directional bias, usually on low volume from one edge of the range to the other. The market will continue to behave like this until a break out occurs.

When these market conditions exist there is only one strategy to consider; To buy the prices near the bottom of the range, and sell prices near the top of the range. The idea is to exit these directional positions as the market returns to ‘value’ by rotating back towards the middle of the trading range.

This is what’s known as a ‘reversion to mean’ trade, or playing ‘ping pong’.

The success of this day trading strategy relies on the market continuing to rotate sideways within its defined trading range. In other words we are betting that the market will continue to rotate up and down inside the established range.

Break Out & Directional

Sooner or later a consolidating market will transition to a directional / trending market. This occurs when the market ‘breaks out’ of its trading range, typically on higher volume and continues to move directionally in one generally sustained direction. When the market does break out, we have a couple of options…

Option #1 is to take a directional position during the break out itself, although this can often be a risky entry as ‘false break outs’ are common.

Option #2 is to wait until the market makes its first pull back after the break out and then take a directional position for any directional continuation. This is the safer entry.

Bottom Line

During an established trading range the smart choice is to either sit on your hands, or play ‘ping pong’ with the edges of the range taking profits when you can.

During a trending market however you want to use a break out or directional strategy and get on board the momentum to maximise your profits.

Whether you trade emini futures, forex, stocks, etf’s or options, being able to identify when the market is consolidating or trending is one of the most important skills a discretionary trader can develop when it comes to consistently applying the right day trading strategies for the market conditions.

Want to learn more?

For a high probability directional trading strategy with easy to understand trade rules, look no further than our very own 9/30 method. Get instant access at the top of this page.

Tags: 9/30, break out, consolidation, day trading, day trading strategies, directional, dual auction market theory, emini, forex, futures, high probability setups, market profile, market structure, price action, stocks, trading range, trending

Leave A Reply (No comments So Far)

No comments yet