How Market Profile can help us to trade break outs and identify profit targets

What you’re about to see is a step-by-step trade review of Friday’s 16 point big break-out move. Extracts taken from our live trading room which is open every day Monday-to-Friday to help our clients become better traders. Further details at the bottom of this page.

Hopefully these extracts will serve to show the value of Market Profile not just as a tool for identifying the current market state, but also the price levels at which break-outs are likely to occur, and even price levels that any subsequent directional move is likely to move to.

The chat transcripts are time stamped with GMT which is 5 hours ahead of EST. 14:30 GMT = 09:30 EST.

14:30 @Sam: ok let’s talk about trade ideas for today in the ES

14:30 @Sam: we’ve just opened up

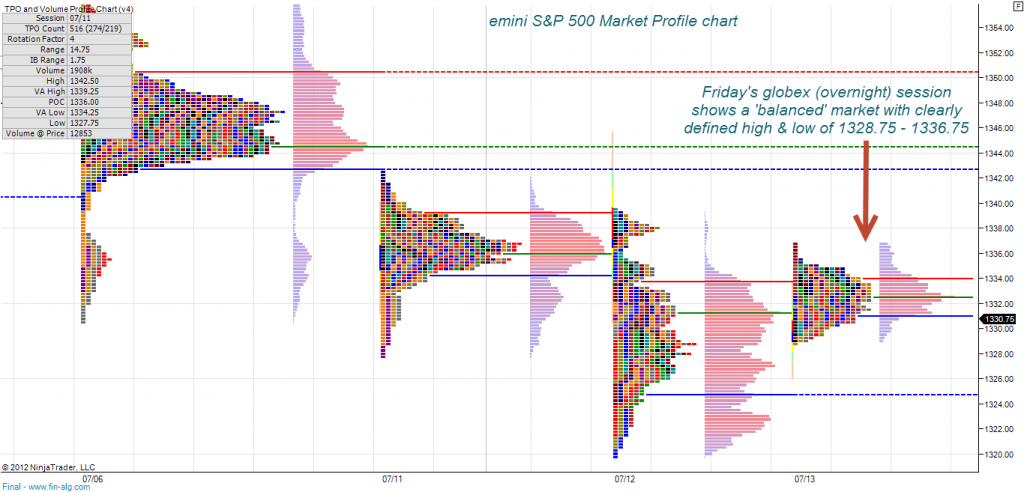

14:30 @Sam: globex high = 1336.75

14:30 @Sam: globex low = 1328.75

14:31 @Sam: we’re currently trading around the middle of that range

14:31 @Sam: so we’re pretty much sideways right now

14:31 @Sam: first trade idea for the day ahead is to watch for a break out of the globex high/low

14:34 @Sam: looks like we’re heading up towards the globex high of 36.75

14:34 @Sam: low volume or a reluctance to break through that price level would be enough to get me short there

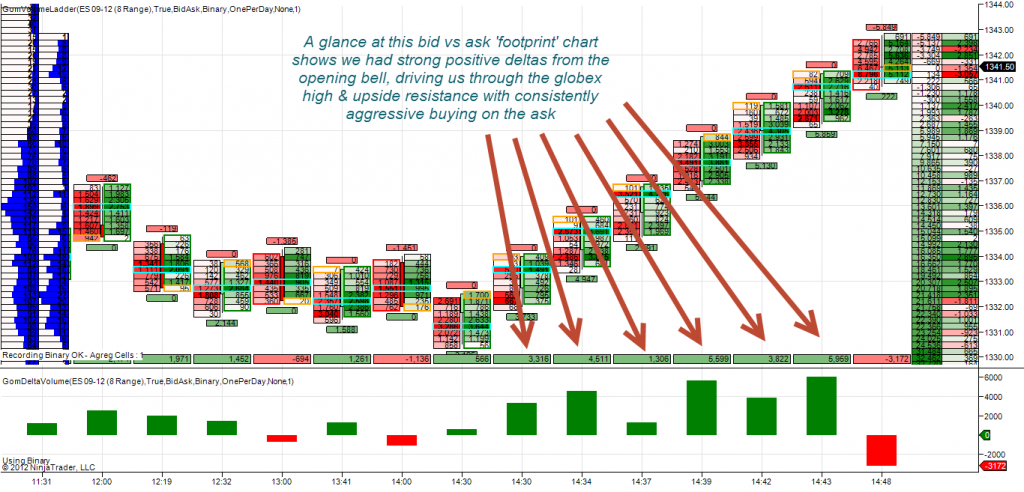

14:35 @Sam: typically, we can’t have a real break-out without a lot of volume

14:35 @Sam: so volume (or a lack of it) is often one of the most useful clues I use to anticipate the market in my own trading

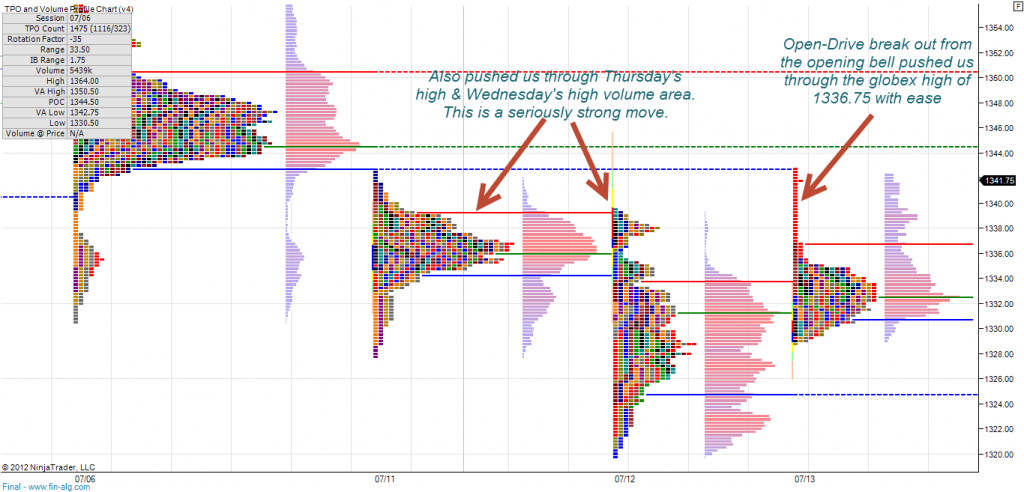

14:40 @Rick M: feels like vol is heavy. wide range bars

14:40 @Sam: yes pretty decent volume breaking through the 36.75 level

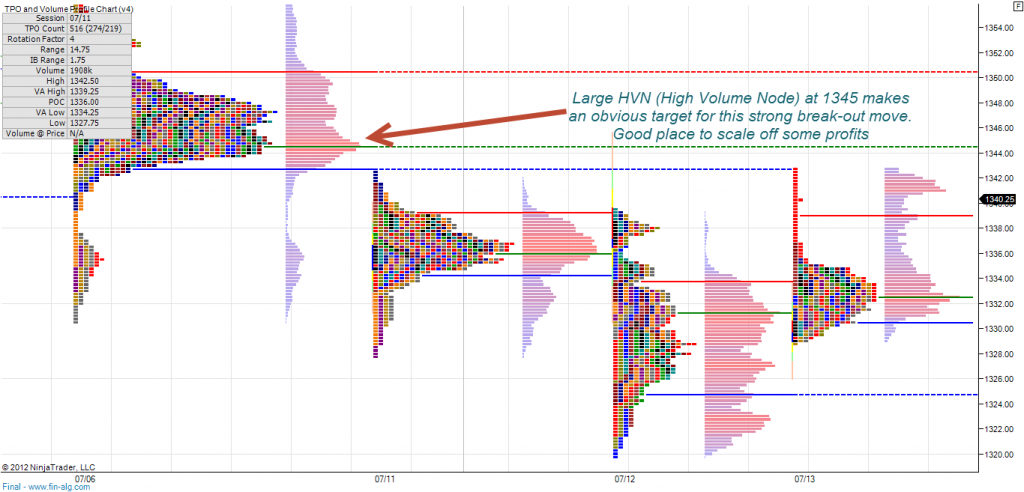

14:45 @Sam: looks like we’re heading to 1344 HVN (High Volume Node)

14:46 @Sam: quick profile update for you

14:46 @Sam: what we’re looking at here is a classic break out from a balanced area (globex range)

14:46 @Sam: see that long buying tail extending up out of today’s profile?

14:47 @Sam: look where it’s reaching for – that high volume area of 1342-44

14:47 @Sam: if there’s any resistance to be found in this market today, that’s where it’ll be

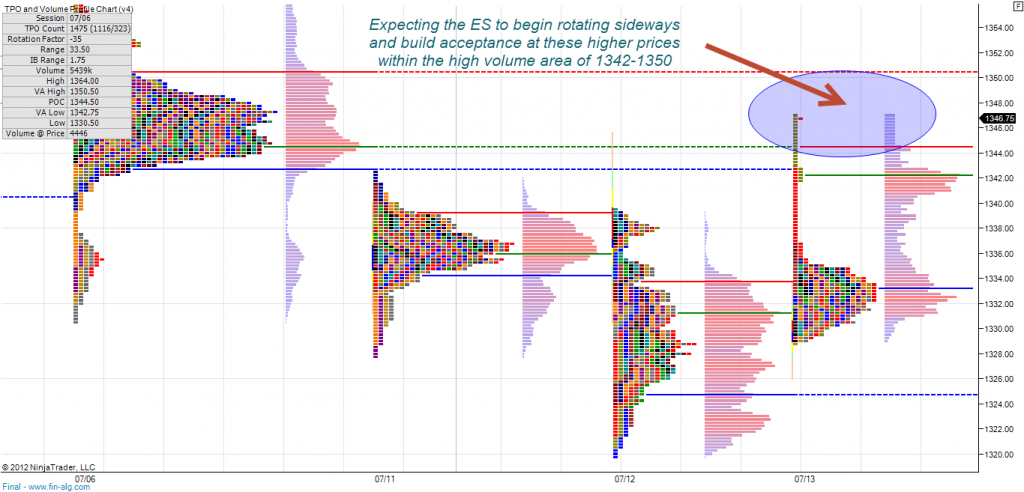

14:58 @Sam: chart updates there to the profile and the footprint chart

14:59 @Sam: we’re starting to see sideways rotations in the ES now

14:59 @Sam: seeking either acceptance or rejection in this 1342-1344 high volume area

15:03 @Sam: new high… now at 44

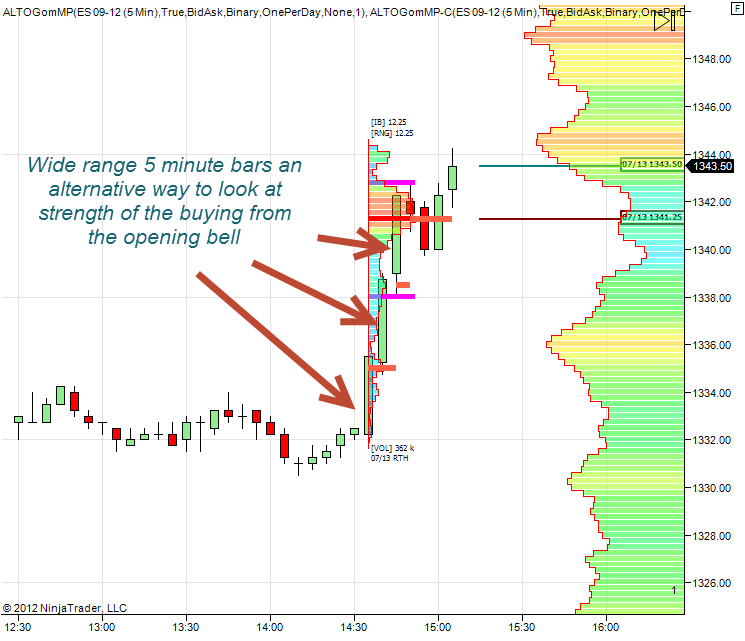

15:04 @Sam: 5 minute bar chart with volume profile

15:05 @Sam: shows clearly those wide rane bars, followed by 10+ minutes of sideways rotation, and now we’re seeing the next push higher

15:06 @Sam: and a profile update

15:06 @Sam: that is a big buying tail this morning!

15:07 @Sam: in market profile – we refer to ‘buying tails’ and ‘selling tails’ when they’re just one TPO (block) that do not overlap

15:07 @Sam: they just go straight up or down like a rocket

15:07 @Sam: and resemble a ‘tail’ ![]()

15:07 @Sam: it’s the sign of a powerful directional move with very shallow retracements

15:08 @Sam: in classical Market Profile terms, we would call this morning an ‘open drive’ from an area of balance

15:08 @Sam: now it’s pushed right into the previous area of balance in the 45 area where I have drawn that elipse

15:08 @Sam: the expectation now is the market will calm down, begin to rotate and move sideways to establish value at these prices again

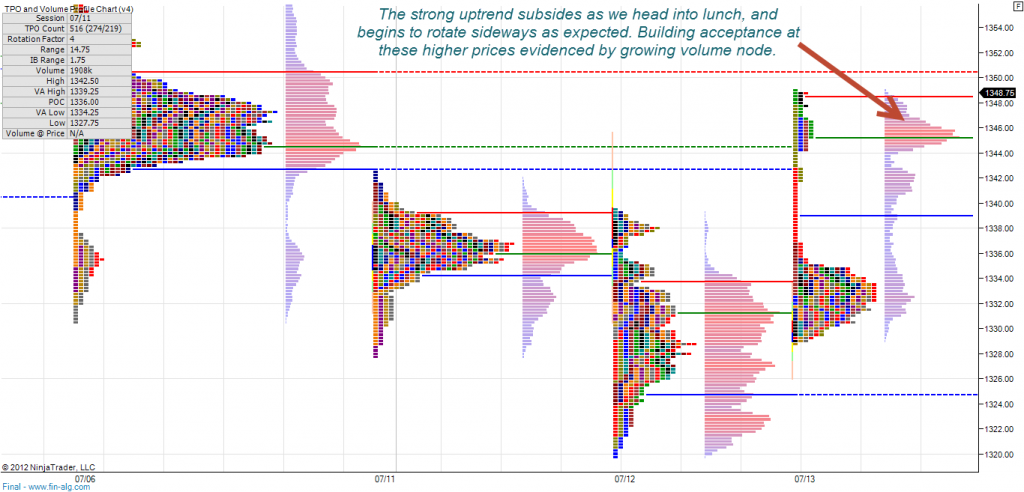

15:45 @Sam: not much to say at the moment

15:45 @Sam: ES still rotating sideways, building out its volume profile here

15:45 @Sam: all suggests price acceptance at these higher price levels

17:06 @Sam: ES reaching for new highs again after spending a good deal of time rotating sideways, building out the volume profile up here

17:07 JoeC: Trend day up characteristics so far.

17:08 @Sam: yes can’t argue with that, Joe!

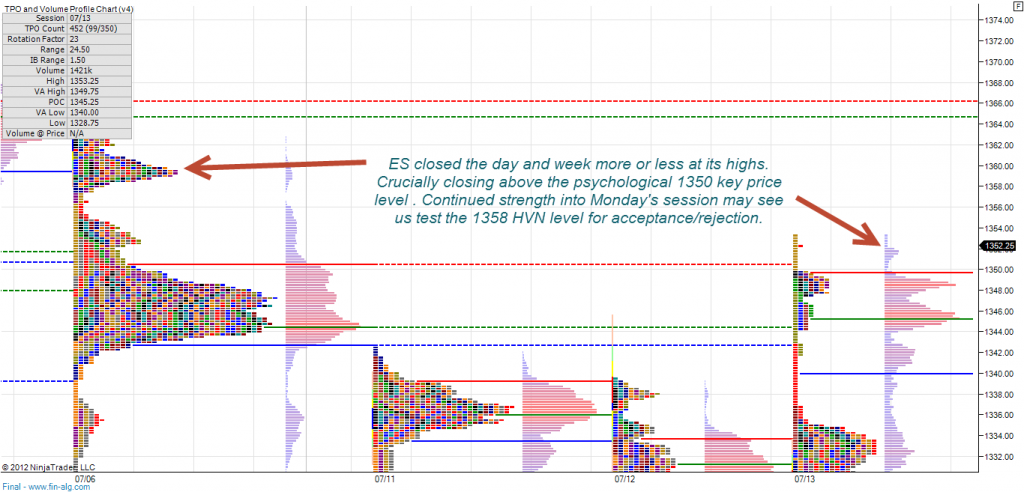

20:03 @Rick M: what is the next level, sam?

20:11 @Sam: good question

20:12 @Rick M: I cant remember what the important levels were above 1350

20:12 @Rick M: maybe 1360 area

20:13 @Sam: pretty much 1358-1360 is the next BIG level up

20:14 @Rick M: the wide range bars right off the open. moving thru the 1340 easily, were strong clues of what to expect

20:15 @Rick M: and should have kept everyone out of a countertrend trade

20:15 @Rick M: my trusty indicator of price trading outside the keltner channel on the hourly chart shows the current momentum

20:16 @Rick M: after the first hour we’ve been outside the keltner channel. don’t advise trading against it.

20:45 @Rick M: see you all Monday

21:22 @Sam: have a good weekend all!

Standard Monthly Subscription Rate: $129 per month

Special Offer Discounted Rate: 7 Day Trial only $10! Then just $79 per month.

You Save 40% – $50 per month!

Click ‘Order Now’ to proceed to our secure checkout page with any major credit card.

Or you can use PayPal…

Leave A Reply (No comments So Far)

No comments yet