What is Fibonacci Trading?

Fibonacci sequences were developed by an Italian mathematician named Leonardo Fibonacci some time in the 10th century. If you want to learn more about its history & origins you can follow this link. For the purposes of Fibonacci trading however, you’ll want to keep reading here.

How does Fibonacci help me to day trade?

Well the theory is simple. In a nutshell… Markets have a tendency to ‘retrace’ a percentage of their previous move before continuing in the original direction.

Fibonacci retracement levels then typically provide us with 3 important areas of interest.

- 38.2%

- 50%

- 61.8%

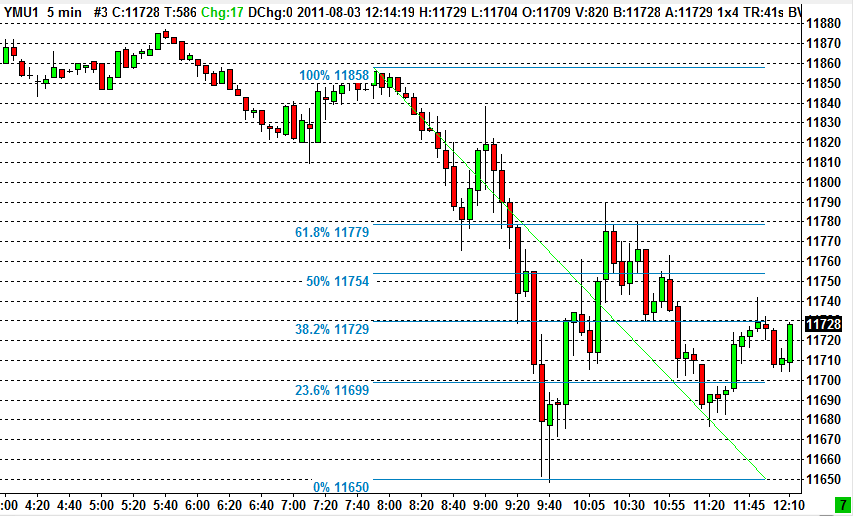

As you can see from the 5 minute YM (mini Dow) chart below, the market recovered more than 50% of its sell off. In fact, the retracement only stopped at the 61.8% Fibonacci level, at which point the market turned around and continued to sell off again.

When the market reaches these key Fibonacci retracement levels, one day trading strategy I like is to begin reading candle stick patterns for clues of a reversal.

If we take the chart above as an example, we have an up (green) candle which briefly pierces the 61.8% level, followed by an inside candle, followed by indecision and a lower high before the market breaks much lower.

That’s a 100 point move right there, and if you can’t make money out of moves like that, you probably shouldn’t be trading!

How do I draw Fibonacci trading levels on my chart?

Practically every day trading software platform available has a Fibonacci retracement tool included, which luckily makes plotting Fibonacci levels a walk in the park.

There is some confusion about the correct way to draw a Fibonacci retracement grid, but follow these guidelines and you’ll be fine;

- Use important highs and lows. Swing points for example.

- In a down trend start from the high first, and plot down to the low. In an up trend, start from the low and plot to the high.

That’s really all there is to it.

Does Fibonacci Trading really work?

Some say the Fibonacci trading sequences have an inexplicable mathematical ability to predict where prices will go next. Others say that Fibonacci trading is pure nonsense and entirely coincidental. I don’t really know.

Personally my own theory is that Fibonacci retracement levels work simply because there’s so many other traders who use them in the same way. I think it becomes a self fulfilling prophecy of sorts.

i.e. When you get a large collection of traders who see the 61.8% Fibonacci level approaching, and they all start thinking ‘this is a good place to take a trade!’, they take their positions and the market moves accordingly.

I know of some traders who do very well trading from Fibonacci retracement levels and candlestick reversal patterns alone. Conversely I also know of other traders who dismiss Fibonacci levels completely as nothing but coincidental and place no value on them at all.

My Take

What I can tell you is that in my own experience I have seen enough market reversals in the ‘golden’ 50-61.8% area to know that Fibonacci levels are at least worth watching. Particularly when there is the confluence of a 9/30 or 3x setup.

The critical part however is you need some means of detecting a reversal signal when the market gets to that golden 50-61.8% area. Candlestick reversal patterns are a good start.

In another article I’ll discuss an interesting ‘new’ take on Fibonacci levels in trading; Fibonacci extensions. An advanced form of Fibonacci trading that Rick uses himself to great effect.

Do you use Fibonacci levels in your own trading? Leave a comment below!

Tags: 61.8%, candlestick reversal, fibonacci levels, fibonacci retracement, fibonacci trading

Leave A Reply (3 comments So Far)

Kelv

13 years ago

Great explanation, starting to use fibonacci myself after Rick’s expert guidance

Rand

13 years ago

the 50% isn’t actually a fib, but it’s obviously a significant retracement & pivot level. I’d suggest studying the concept of ‘half-way’ pivot zones, using the 25, 50 & 75% rather than the fibs.

David

13 years ago

Thanks for the info, I use the 50ema daily hour and the 5min, for R/S. I find it works well.